Asymmetry

This term relates mostly to marketplaces, whether that marketplace is 1, 2, 3, or N-sided. In nearly every marketplace, one side, or one type of node, is harder to acquire than the other.

In some cases, the harder side of the marketplace is the demand side - the buyers. Usually in this scenario, if you can manage to attract people who are willing to pay (buyers), suppliers (sellers) will show up quickly and without as much effort. We call this a "demand-side marketplace".

Fiverr and UpWork are examples who focus on finding demand and rely on supply to show up organically. Lending Club is another example. They focus their efforts on finding demand (borrowers) for the money, and the lenders show up on their own to provide the money for those borrowers.

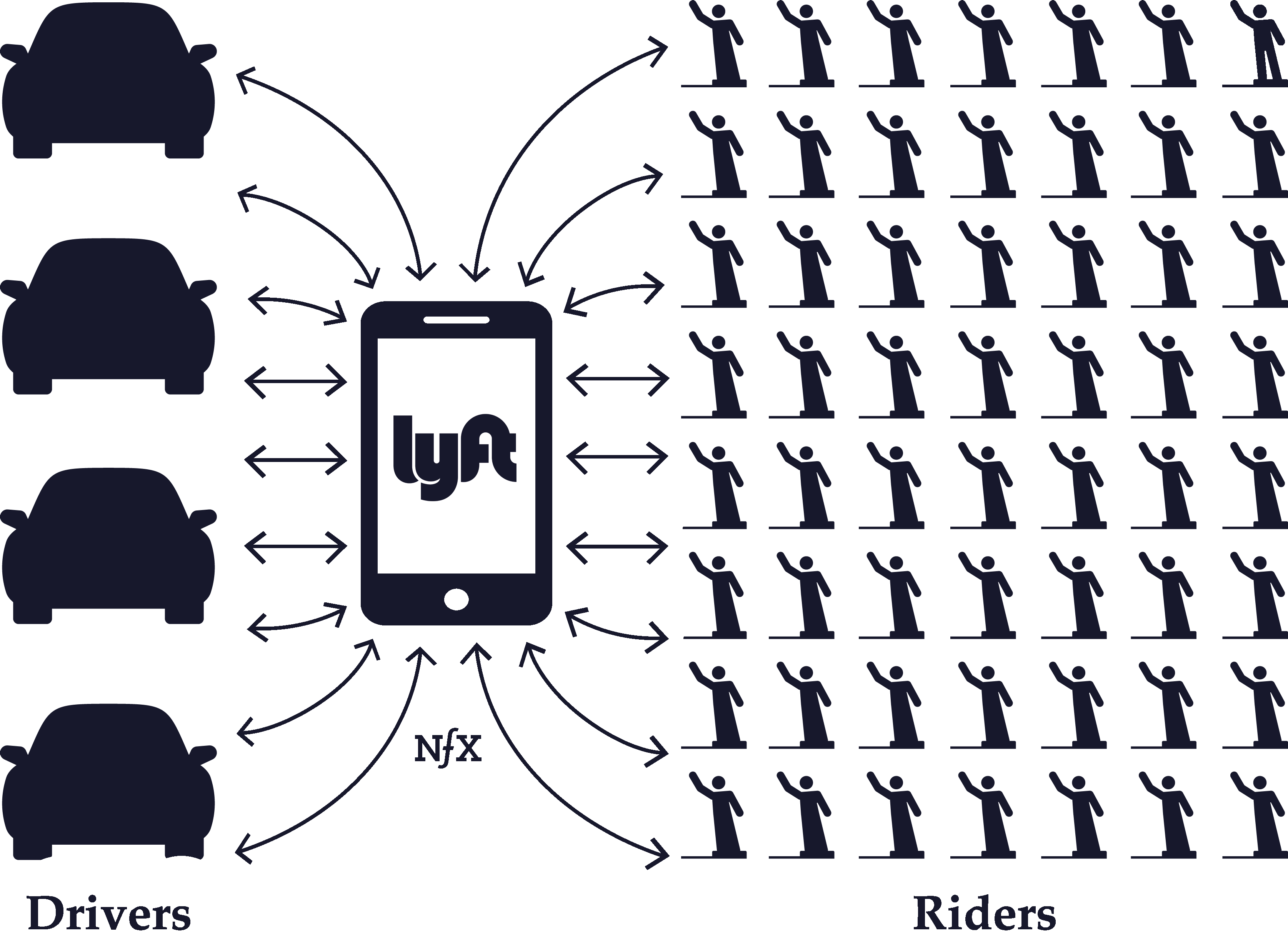

In some cases, the harder side is the supply, and demand-side users are attracted to the marketplace organically once the supply side is robust. We call this a "supply-side marketplace." For instance, Uber and Lyft spend the majority of their paid acquisition budget on driver acquisition - the supply side. Similarly, OpenTable had to slowly acquire restaurants, the supply side, one by one, until it had built up enough supply after seven years to attract demand (people looking to make restaurant reservations).

Of course, in some markets, if you are unlucky or unwise in your target sector, you will find that both sides are equally hard to attract. That makes things very hard.

Another asymmetry in marketplaces relates to the asymmetry within a side or within a type of node. In other words, not all supply or demand is made equal. Typically, there are certain nodes who will prove more valuable to get on your network, sometimes proving up to 1,000X more valuable than other nodes.

Look for these various asymmetries in a marketplace and prioritize which types of demand or supply will be the best to attract first, second, and third. Then focus on developing tactics to crack the highest-value target first.