The Rise of Decentralized Perpetual Exchanges in the Crypto Market

Decentralized Perpetual Exchanges are revolutionizing the world of cryptocurrency trading by offering traders the ability to enter long or short positions with no expiration dates. Unlike traditional exchanges that involve set expiration for futures contracts, decentralized perpetual exchanges allow for continuous trading without the need to roll over positions or settle at predetermined dates. This gives traders more flexibility and control, creating opportunities for profit regardless of market conditions. By enabling users to trade with leverage, decentralized perpetual exchanges have become a game-changer, offering enhanced risk management tools and opportunities for traders of all experience levels.

Advantages of Using Decentralized Perpetual Exchanges

One of the most significant advantages of decentralized perpetual exchanges is the inherent security and privacy they offer. Since these platforms operate on decentralized blockchain networks, they eliminate the risks associated with centralized platforms that are vulnerable to hacking and data breaches. Users retain full control over their funds and private keys, ensuring that no third party has access to their assets. Additionally, the absence of intermediaries or central authorities in decentralized systems reduces the potential for manipulation, allowing for a more transparent and fair trading environment. This enhanced security and autonomy are key reasons why traders are increasingly flocking to these platforms.

Empowering Traders Through Defi Trading Platforms

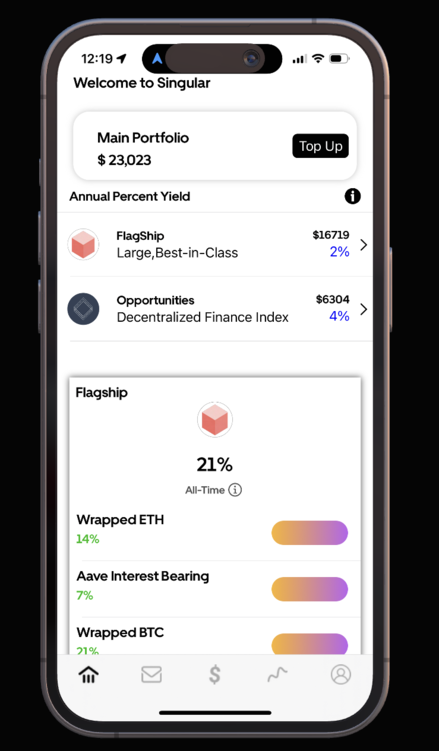

DeFi (Decentralized Finance) trading platforms have taken the crypto industry by storm, providing individuals with unprecedented access to a wide range of financial services without the need for traditional banks or intermediaries. By leveraging blockchain technology, these platforms enable peer-to-peer trading, lending, and borrowing in a decentralized manner. One of the most compelling aspects of DeFi trading platforms is their ability to offer users control over their financial transactions and assets, reducing reliance on centralized systems. This shift towards decentralization is empowering traders and investors to operate in a more open, transparent, and secure environment, which is driving the growth of DeFi ecosystems.

How Decentralized Perpetual Exchanges Enhance Leverage Trading

Leverage trading allows traders to control larger positions in the market with a smaller initial investment, which can significantly amplify both potential profits and risks. Decentralized perpetual exchanges provide an innovative way to engage in leverage trading without the traditional restrictions and complexities of centralized platforms. These exchanges use smart contracts and decentralized protocols to facilitate leveraged positions, giving traders the ability to take on more exposure while mitigating the risk of counterparty default. With leverage available through decentralized perpetual exchanges, traders can maximize their potential returns in volatile markets while managing risk effectively, all within a secure and decentralized ecosystem.

The Role of Liquidity in Decentralized Perpetual Exchanges

Liquidity plays a crucial role in the success and efficiency of decentralized perpetual exchanges. In traditional markets, liquidity is typically provided by centralized market makers or institutional players, but in the decentralized world, liquidity is provided by individual traders and liquidity pools. The decentralized nature of these exchanges allows for greater market depth and a wider variety of assets, as liquidity can be sourced directly from users and liquidity providers. This peer-to-peer liquidity model ensures that trades are executed quickly and efficiently, with minimal slippage. As liquidity continues to grow on decentralized perpetual exchanges, these platforms become even more attractive for high-frequency traders and institutions.

Conclusion

decentralized perpetual exchanges and DeFi trading platforms are leading a revolution in the way individuals engage with financial markets. These platforms offer a higher level of security, transparency, and autonomy compared to traditional centralized exchanges. By eliminating intermediaries and central authorities, decentralized systems empower traders and investors to take control of their financial assets and make informed decisions. As technology continues to evolve, the future of decentralized trading looks bright, and platforms like singulardex.com are at the forefront of this transformation, offering innovative solutions that cater to the needs of modern traders.

Blog Source Url :- https://singulardex.blogspot.com/2025/05/the-rise-of-decentralized-perpetual.html